- E-commerce to account for AED 12 billion of local GDP by 2023

- Unprecedented Worldwide record growth of e-commerce paves way for regional investment

- Global health challenges drive Arab countries to rely on its local production and markets

Dubai Future Foundation has launched the third in a series of reports that outline the best ways to tackle diverse challenges that organizations in the Arab world and globally will face once the COVID-19 pandemic finally abates. The series comes at a crucial time when public and private sector organizations are seeking to prepare for future opportunities and challenges.

Titled ‘Life After COVID-19: Commerce’, the report recounts that trade is a major sector in the global economy and a key driver of its growth. In 2018, the value of global merchandise traded reached US$19.67 trillion, and was growing at 3.0 percent. Declining from a high of 3.9 percent in 2017, the drop to 3.3 percent by end-2019 contributed to the weakening of global economic growth, and the slowdown of China’s economy growth.

At the same time, global trade witnessed a decline of about 0.8 percent until February 2019, compared to the same period in 2018. The continued global trade slump through the year raised red flags of a possible worldwide recession, similar to the global financial crisis of 2008. The world looked at 2020 with hope to help turn the tide and lead to a resurgence of trade in various sectors, but the scene has completely changed.

The report underlines that commerce, which includes supply chains, retail, trade, banking, manufacturing and transport, is dependent on a global network to flourish. While this was an advantage, politically and economically, prior to the pandemic, the weakening of this global network now means that the economy is headed directly into a recession with little hope of any short-term turnaround.

Furthermore, the report cites experts who claim that much of the world’s retail sector will become digitalized. Although this may not make up for short-term losses of the bricks-and-mortar retailers, with many online outlets already linked directly to physical stores, it is likely that the retail sector will be hurt both digitally and physically by an economic downturn and declining demand. The global maritime supply chain, which plays a significant role in supporting the world’s trade and goods imports, has been disrupted in several countries due to fears of transmitting the virus across regions. Borders have been closed and more countries, including the Arab world are looking inwards to maintain business continuity.

The UAE has adopted a strategic direction based on economic diversification, and worked to enhance its regional and global trade position to become the leading regional trade hub, with foreign trade value exceeding AED 8.1 trillion between 2014-2018.

The report notes that before COVID-19, China was a leading trade partner for the UAE, accounting for over nine percent of the country’s non-oil trade. Local supply chains are likely to face steep challenges in alleviating import dependence and in replacing such large volumes of production and manufacturing in the era of a global pandemic and highly controlled borders. Although Dubai has returned to importing goods from China, where the coronavirus is being tackled with stringent measures, the current economic impact of decreased trade has brought to light the larger issue of dependence on limited suppliers and trade partners.

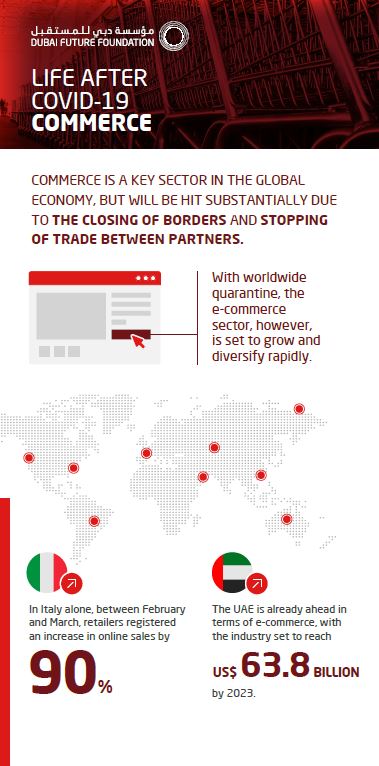

E-commerce has become more prevalent globally, and with quarantine impacting an increasing number of people worldwide, the sector is set to grow and diversify even more rapidly. Some studies predict that e-commerce is expected to surge to 16 percent with over US$26 trillion by 2020.

In Italy alone, between February and March 2020, retailers registered an increase in online sales by a whopping 90 percent. The UAE’s digital economy contributes 4.3 percent to the GDP and Dubai’s e-commerce industry is set to account for AED12 billion of the local GDP by 2023.

The report further foretells that the established digital infrastructure will become increasingly important during and after a worldwide quarantine, as more jobs and services move online. In Dubai for instance, Dubai Police have leveraged artificial intelligence to monitor cars and determine which motorists needed to be fined for driving during the curfew. Technology helps identify cars that have been issued a movement permit, cars owned by people working in vital sectors, and cars that don’t belong in either of these categories.

The report highlights that during the COVID-19 outbreak, short-term digital infrastructure is key to ensuring business continuity for companies in the Arab world. Dubai has put in place platforms, such as UAE pass, the national digital identity and digital signature solution for the UAE, for all digital transactions, but the complete digitalization of public and private sector systems across the board will be necessary if work remains remote for an extended period of time.

For the long-term, the report states that automation and new technologies will become the preferred solution in trade and production related work. Factories will be repurposed for post COVID-19 work, and employees are set to be reskilled so that they don’t lose their jobs.